VANECK FILES FOR SOLANA ETF FOLLOWING BITCOIN AND ETHEREUM SUCCESSES

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets

VanEck, a prominent investment manager, just made waves by filing for the first Solana ETF in the United States. This ambitious move shows the growing interest in Solana, a rapidly growing blockchain ecosystem known for its high speed and low transaction costs.

VanEck’s filing for a Solana ETF surprised many, especially coming so soon after their Bitcoin and Ethereum ETF filings. Solana is promising but still young compared to Bitcoin and Ethereum. Matthew Sigel, VanEck’s head of digital assets research, says Solana should be a commodity like Bitcoin and Ethereum due to its decentralized nature and similar functions. This goes against the Securities and Exchanges Commission’s (SEC) past stance, which considered Solana as a security in its actions against major crypto exchanges.

Historically, the approval process for crypto ETFs has been fraught with challenges. The SEC allowed the first Bitcoin ETF listing after long years of regulatory struggles. Ethereum ETFs are expected to get accepted soon, which could open the door for other altcoin ETFs. VanEck filed to list its new Solana ETF on the Cboe BZX Exchange. They promise to value the shares based on the MarketVector Solana Benchmark Rate.

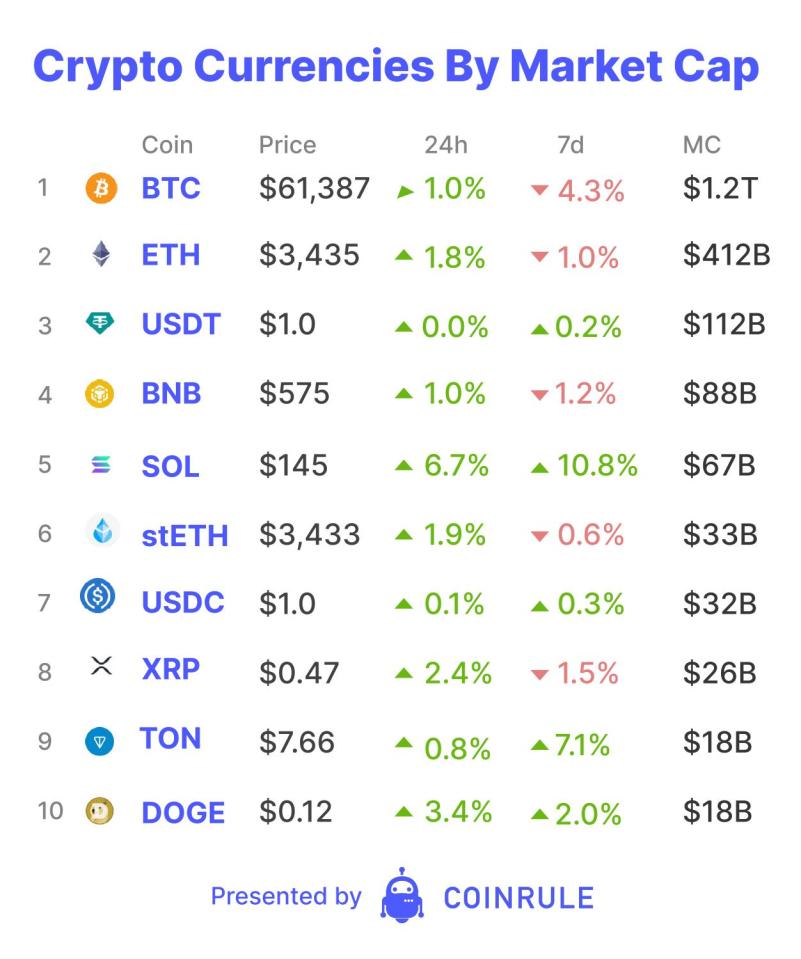

The announcement had an immediate impact on Solana’s market performance. Solana’s price surged by nearly 8% following the news, reflecting investor enthusiasm and market confidence in VanEck’s strategic moves. This spike shows the broader impact of ETF approvals, which provide institutional and retail investors with a legally straightforward way to gain exposure to cryptocurrencies without directly holding them.

However, approval from the SEC for this filing remains highly uncertain. The current SEC administration has shown little appetite for approving crypto ETFs without a fight, citing regulatory concerns and market stability. Previous filings, especially for Bitcoin and Ethereum ETFs, faced significant hurdles, suggesting that VanEck’s Solana ETF would face steep regulatory resistance.

The crypto community remains hopeful but cautious. VanEck’s smart strategy and use of social media suggest the filing might be a clever PR move. This could strengthen its role as a leader in digital asset investments. However, the approval process is uncertain, especially since CME futures volumes for Solana might not meet the requirements, leading to possible rejection on these grounds alone.

VanEck’s Solana ETF filing is a bold step that could reshape crypto investments. Whether this move ushers in a new era of altcoin ETFs or remains a pure PR play will be interesting to watch.